What the donor-advised fund payout rate means for philanthropy and how it fits into the bigger charitable giving picture

Those of us who work with donor-advised fund (DAF) donors every day know that they are caring, committed, and creative givers. We also know they use DAFs for both their long- and short-term giving. This has never been more apparent than in the past year, when grantmaking from DAFs skyrocketed in response to the COVID-19 pandemic. While generosity is not a calculation, the donor-advised fund payout rate is an important philanthropic benchmark.

What is the DAF payout rate?

The DAF payout rate is a calculation of grantmaking dollars awarded from DAFs to charities relative to the total charitable assets in those DAFs. More simply: it’s how much DAF donors granted compared with what they could have granted.

How should we calculate payout rate?

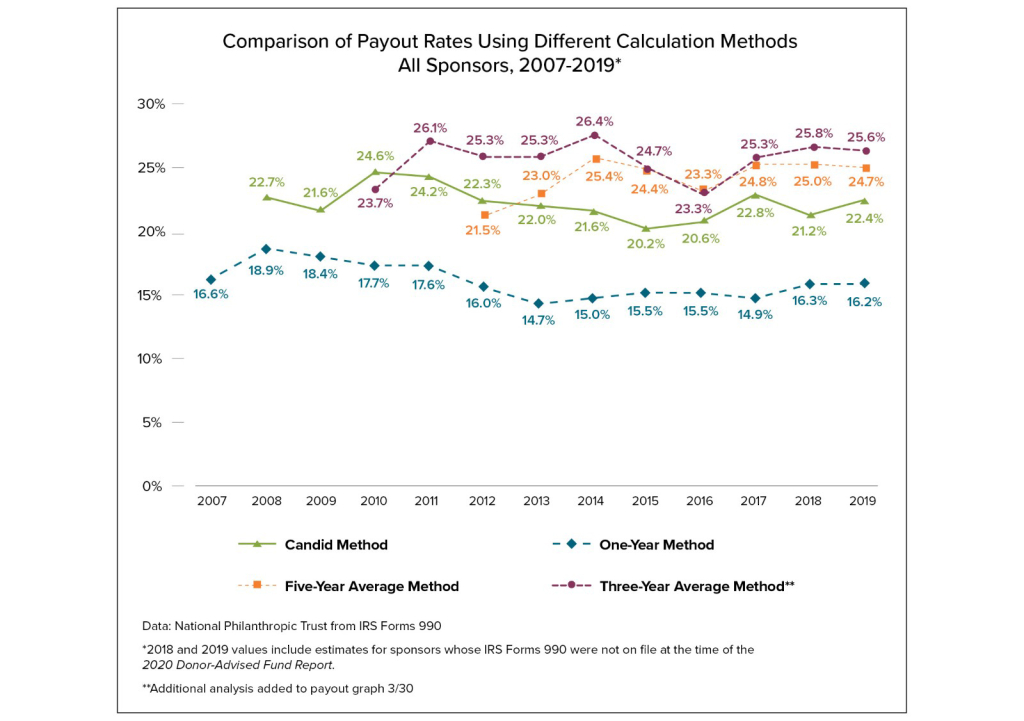

Candid uses a formula to estimate payout from private foundations that National Philanthropic Trust (NPT) replicates in our annual Donor-Advised Fund Report. The Candid formula is:

This year’s grant $$ ÷ Previous year’s charitable assets = payout rate

For 2019, the latest year for which aggregated data is available, the formula is:

FY19 grants ÷ FY18 charitable assets

or $27.37B ÷ $122.18B = 22.4% payout

NPT uses the Candid formula for several reasons. First, like DAFs, private foundations are widely used giving vehicles for both short- and long-term philanthropy, so using the formula creates a useful point of comparison between the two types of vehicles.

Second, the formula is not just an industry standard, it’s practical. The Candid formula reflects common budgeting techniques — that is, plan for the current year based on the prior year’s income and expenses and factor in the remaining balance (if any).

Third, other payout-rate formulas ignore certain practical and particular aspects of giving to and from DAFs, such as the time between the date of contribution and the availability of the funds for grantmaking. More on this below.

A look at other ways to calculate payout rate

Since there is no mandatory payout requirement for DAFs, there are several reasonable ways to calculate it.

The “Three-Year Average” and “Five-Year Average” methods use the average of the charitable assets held by DAFs over two different periods. These formulas are also allowed by the IRS as a way for private foundations to calculate their payout. Using multiyear averages can smooth out any “lumpiness” in either major contributions or grants. However, for fast-growing giving vehicles such as DAFs, it also generally underestimates charitable assets available, as the year with the highest total — typically, the most recent year for which aggregate data is available — is averaged with lower values from earlier years.

The “One-Year” method, a formula that NPT used to calculate DAF payout in our annual Donor-Advised Fund Report prior to 2014, uses grants and charitable assets (plus grants) in the same year to calculate payout. This formula assumes that every dollar contributed to a DAF can be immediately granted out, which can have the effect of overestimating the value of assets that are truly available for grantmaking.

For example, a donor who contributes to her DAF in the last days of December (and receives her tax deduction at that time) will recommend grants from those DAF charitable assets the following year and beyond.

How do we put the DAF payout rate into context?

The Candid method offers the best point of comparison. As a vehicle for giving, private foundations are similar to DAFs, and this method most accurately represents payout by using numbers that reflect the amount granted relative to what is definitively available for grantmaking.

It’s also worth noting that private foundation payouts can include eligible operating and administrative expenses, such as staff salaries, overhead, and administrative expenses. By contrast, DAF payout takes into account charitable grantmaking only and does not include any of the DAF sponsors’ operating or administrative expenses.

Using the Candid method, DAF payout is typically at least four times higher than that of private foundations. While foundations typically grant out the legally required minimum of 5 percent of their assets annually, the DAF payout rate has been above 20 percent for each of the last ten years.

All of the proposed formulae show that the DAF payout rate is historically and consistently higher than that of private foundations. And as such, it helps us understand that DAF donors are committed to the charities they support over both the short and long term.

DAFs provide substantial and sustained support

A consistent DAF payout rate is good news for charities. DAF donors have proven that they are a sustainable source of charitable support. They give dependably across economic cycles (yes, DAF donors gave at a 20+ percent payout rate through the Great Recession); through political seasons (no, there’s no need to worry that campaign giving reduces charitable giving by DAF donors); and in the face of great challenges (natural disasters, global pandemics, mass social movements, etc.). The data is clear: DAF donors are committed to the long-term viability of nonprofits.

The DAF payout rate is an important metric, and it’s not the only way to measure philanthropic activity from DAF donors. Grantmaking from DAFs has nearly doubled over the last five years — a clear signal that DAF donors are active givers. In fact, growth in grantmaking from DAFs (93 percent) has outpaced growth in contributions (80 percent) to them over that period.

DAF donors’ response to the COVID-19 global pandemic — which saw grantmaking from DAFs soar 33 percent on a year-over-year basis — is yet another indication of their philanthropic commitment. So is the fact that they have irrevocably donated money to DAFs that can only be used for philanthropic purposes.

While there is no magic formula that can make people give, DAF donors have consistently chosen to do so quickly and generously.